Well, it seems the DoD, sorry, DoW, has really gotten a taste for critical minerals. Yesterday, Australian-American mining company Nova Minerals ($NVA) announced that it’s scored a $43.4M investment from the Pentagon to build out a production plant for a critical mineral called antimony in Alaska.

The funding was awarded under the Defense Production Act to the company’s US subsidiary, Alaska Range Resources, and will enable the DoD to have a “fully integrated US antimony supply chain,” according to Nova.

Love a little military-civil fusion on a Friday.

Dig deep: You might be sitting there thinking, “C’mon guys, I’m here to read about tech, not have trauma flashbacks to the periodic table.” Well, stick with us—critical minerals like antimony are key to all the whizzy, fly-y, shoot-y things we all know and love. Why the heck do you think the DoD is pouring so much money into a mine in the far north?

Antimony is a silvery-white semi-metal (fun) that is officially classed by the DoD as a critical mineral because of how important it is to a whole range of defense applications.

- It’s used (alongside lead) to harden bullets, artillery shells, and shrapnel—hundreds of different munition types.

- Antimony trisulfide—which Nova will be producing—is a key primer for explosives.

- The mineral is also used in infrared sensors, radar systems, lasers, and—critically—liquid metal batteries.

The problem is, the US simply doesn’t have enough of the stuff to go around—the US holds about 1,100 tons of antimony in its stockpile, but US demand in 2023 (and this is likely to go up) stood at around 23,000 tons. Those are certainly, um, different numbers.

That means, once again, we’ve got to turn to our favorite frenemy—China. China accounts for about 50 percent of the world’s antimony supply, and about 63 percent of US imports of the mineral (the US imports about 82 percent of its antimony supply overall). But last year, China put super-strict export controls on critical minerals—including antimony—pretty much cutting off supply.

Bring it back: The US—and the DoD—have been scrambling to find a domestic solution. Last month, the U.S. Defense Logistics Agency awarded a big ol’ $245M, 5-year contract to the United States Antimony Corporation (USAC) to rebuild the country’s antimony stockpile, and now DoD is straight up investing in Nova. With demand set to rise—everyone loves munitions and sensors—this seems like not the worst idea.

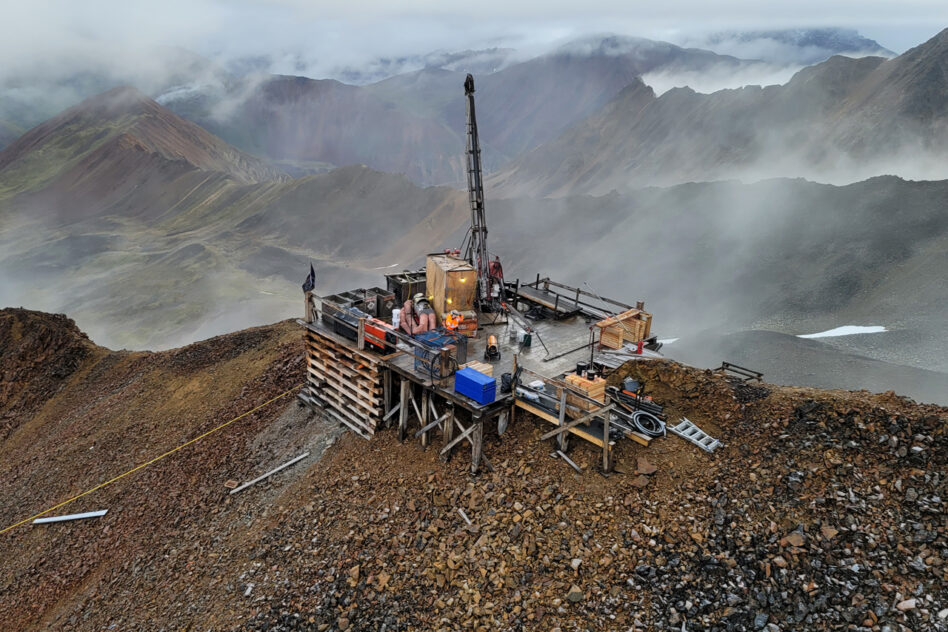

Nova says that this investment will enable them to “establish a full spectrum state of the art antimony mining and refining hub based in Alaska to supply refined antimony products to the U.S. industrial base and beyond.” Let’s get digging.

Snap it up: Antimony isn’t the only thing the DoD is worried about on the rare earths and critical minerals front. Back in July, the Pentagon announced that it would invest $400M in rare earths mining giant MP Materials, acquiring a 15 percent stake in the company. MP is building out new production and processing facilities for these oh-so-special rare earths, critical to building things like high-powered magnets.

Basically, the government is pouring money into these mines and facilities to shore up supply before it’s too late (cough, 2027, cough). Did someone say big government?