The DoD, sorry, DoW, has really gotten a taste for critical minerals. On Monday, rare-earth magnet maker Vulcan Elements announced a whopping $1.4B partnership with the Pentagon, Department of Commerce, and ReElement Technologies to scale their vertically integrated rare-earth magnet supply chain.

Sounds like the meeting with Xi wasn’t that good.

Rare air: Drones have been getting a lot of lip service from the Pentagon, but critical minerals have scooped up a lot of the cold, hard cash. Just in October, the US:

- Signed an agreement with Australia to finance over $1B in rare-earth and critical mineral projects in both countries, along with announcements of joint investments in critical minerals supply chains in Thailand and Malaysia.

- Invested $43.4M into mining company Nova Minerals through the DoD to build out a production plant for a critical mineral called antimony in Alaska.

- Announced a $1.8B investment with the Abu Dhabi sovereign wealth fund for critical mineral mining and refining projects alongside PE fund Orion Resource Partners.

All that comes after the DoD shelled out $400M for a 15 percent stake in Las Vegas-based rare-earth mining company MP Materials, along with a separate $150M loan, in July.

Money magnet: Now, North Carolina-based startup Vulcan Elements is getting its time in the sun. FWIW, this comes just a few months after raising a $65M Series A led by Altimeter at a $250M valuation. Good bet, guys.

Under the $1.4B deal, Vulcan will receive a $620M direct loan from the DoD’s Office of Strategic Capital (OSC), $50M in federal incentives from the Department of Commerce under the CHIPS and Science Act, and $550M in private capital to scale its manufacturing capacity and rare-earth magnet processing partnership with rare-earth purifying and refining company ReElement.

- Uncle Sam is also getting his cut of that magnet money, taking $50 million of equity in Vulcan Elements through the Department of Commerce.

- ReElement, for its part, will receive an $80M direct loan from the OSC to expand its recycling and processing capacity, which’ll be matched by private capital.

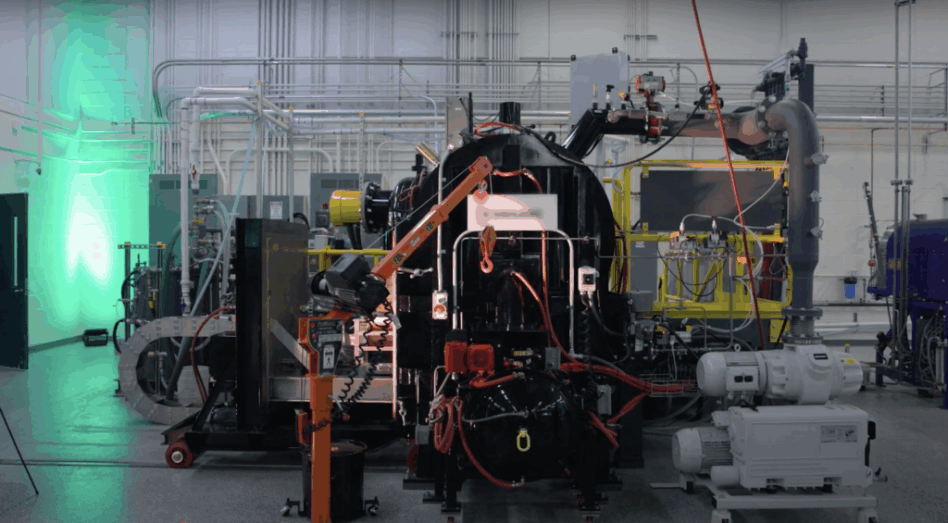

A big chunk of that money will go toward building and operating a 10,000 metric ton magnet facility in the US—location TBD. In the meantime, “We’ll be ramping up existing production in our current facility in 2026 and then really ramping that up in the facility that we’ll announce in 2027,” Vulcan CEO John Maslin told Tectonic in an interview.

Better together: Put together, Vulcan and ReElement basically create a closed-loop supply chain for rare-earth magnets.

- ReElement processes end-of-life magnets, mined concentrates, and electronic waste into high-purity rare-earth oxides.

- Vulcan reduces those oxides to manufacture the finished rare-earth magnets.

- The two companies announced a commercial-scale agreement in August for “light” and “heavy” oxides (the materials needed to produce rare-earth magnets).

“We’re expanding an existing partnership and moving that to a larger scale,” Maslin said. “They make [a] real product that is at our spec that we’ve tested and used, and that alone is massive.”

The panda in the room: There’s a good reason the government is so hot on Vulcan and other US rare-earth and critical mineral companies.

- China processes upwards of 90 percent of the world’s rare-earths—only slightly more than the US’s 1 percent.

- Rare-earth magnets—made from neodymium iron boron (NdFeB), in Vulcan’s case—are found in everything from F-35s to nuclear subs and drones because of their magnetic strength, thermal stability, and miniaturization capabilities. They basically turn electricity into motion.

- Put simply, they’re a BFD and a big-time chokepoint for all of the defense tech we all know and love. China has already shown a willingness to flex its power over rare-earth exports in trade talks, which isn’t ideal given that 80,000 parts in DoD weapons systems rely on critical materials under Chinese export controls, according to Govini.

That’s been a big—and lucrative—boon for US rare-earth companies working to decouple the rare-earth supply chain from China, but despite the big-dollar deal, Vulcan is keeping its eyes on the prize.

“We’re not over here popping bottles of champagne,” Maslin told Tectonic. “We’re saying that we need to execute and get this done the right way and at the right pace, because this is bigger than any single one of us—this is about delivering for the country and our friends.”