Between the rollercoaster Ukraine mineral deal and the Pentagon’s $400M investment in MP Materials, rare earth minerals have been all the rage in 2025.

And yesterday, they got even more hyped when North Carolina-based rare earth magnet processing startup Vulcan Elements announced a $65M Series A led by Altimeter, bringing total funding to $75M. The company is now valued at $250M.

For context: Here’s a quick rundown on why there’s so much attention on these rare earth magnets:

- Rare earth magnets—made from neodymium iron boron (NdFeB), in Vulcan’s case—are found in everything from F-35s (900 pounds of rare earth materials in each) to nuclear subs (9,000 pounds) and drones because of their magnetic strength, thermal stability, and miniaturization capabilities. Put simply, they turn electricity into motion.

- China processes upwards of 90% of the world’s rare earths—only slightly more than the US’s 1%.

- The Pentagon has rushed to decouple the rare earth supply chain from China, including by investing $400M in rare earths mining company MP Materials last month.

- Congress, meanwhile, prohibited the use of Chinese magnets in the DoD under the FY2021 NDAA, which kicks in in 2027, and required country of origin tracking at every processing step for magnets in the 2023 NDAA.

The China chokepoint: The giant panda in the room has already caused some problems.

China limited the export of critical minerals to US defense companies this spring, which is not ideal given that more than 80,000 parts in DoD weapons systems rely on critical materials under Chinese export controls, according to Govini.

If tensions heat up, you can bet on China flexing its magnet muscles even more, hence the US’ laser focus on shoring up its own supply.

Before the past few years, “People hadn’t been paying enough attention to rare earth elements and magnets,” Vulcan Elements CEO John Maslin told Tectonic. “It’s the third leg of the stool that will define the 21st-century technology race, on the same plane as semiconductors and batteries.”

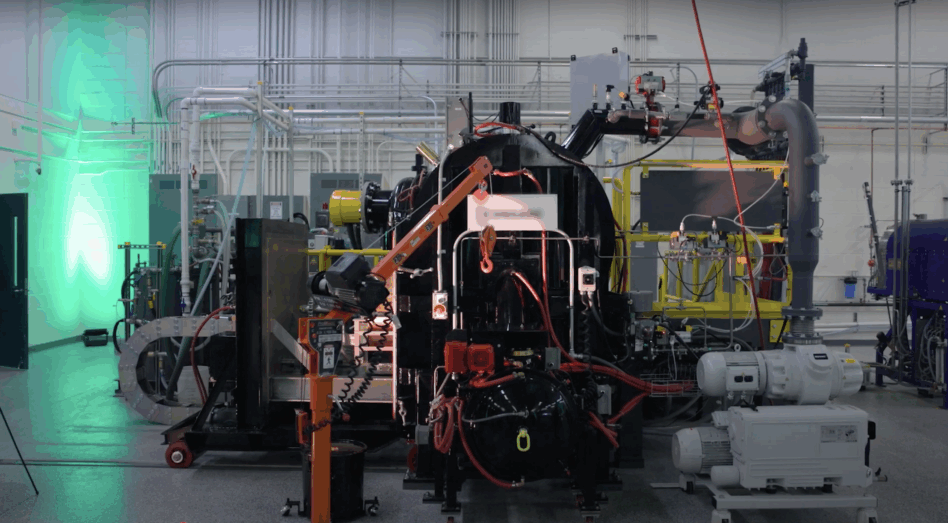

Magnet money: With the Pentagon going cold turkey on China-linked magnets in 2027, US and allied magnet makers are gearing up to fill the gap. According to Maslin, the $65M will go towards scaling up Vulcan Elements’ manufacturing capacity from its 10-ton pilot facility, which opened in March.

“The point of this raise is to expand that to several hundred tons over the next couple of years and several thousand tons by the end of the decade,” he said, adding that Vulcan Elements is looking for a new facility site now.

To hit those big goals, it helps to have good partners, and Maslin feels good about their friends at Altimeter. “They’ve helped build companies in the deep tech space, and they’ve seen the movie before,” he said. “They’ve seen where things go wrong and where things go well, so having investors who understand what hardware success looks like is phenomenally important.”

Even with the cutoff threat from China and the looming 2027 deadline, Maslin and Vulcan Elements are confident that America’s industrial capacity will rise to the challenge.

“I’m not one to discount what Americans can do within a very short period of time,” Maslin said. “It’s going to take a whole-of-industry and government approach, but at the end of the day, this needs to happen in America immediately.”