Looks like the White House just can’t quench its thirst for the minerally good stuff.

This morning, Bloomberg reported that the Trump administration is set to launch a critical mineral stockpile, called Project Vault, backed by $12B in seed money split between $1.67B in private capital and a $10B loan from the US Export-Import Bank.

The goal of the initiative is to protect industry from supply chain shocks as the US works to curb reliance on the Chinese critical minerals that are oh so important for everything from iPhones to fighter jets and nuclear subs.

Panda in the room: If we’ve learned one thing from China’s response to US tariffs, it’s that the critical mineral card is a pretty strong one. Early last year, China tightened exports of rare earth minerals to Western defense firms, forcing trade concessions during negotiations in June. While the flow has increased since then, China has maintained stricter restrictions on critical minerals used in defense technologies.

Mineral money: Given that China processes upwards of 90 percent of the world’s rare earths, that’s a pretty glaring vulnerability (especially if, say, we decided to help protect a certain little island), and the White House has clearly taken note:

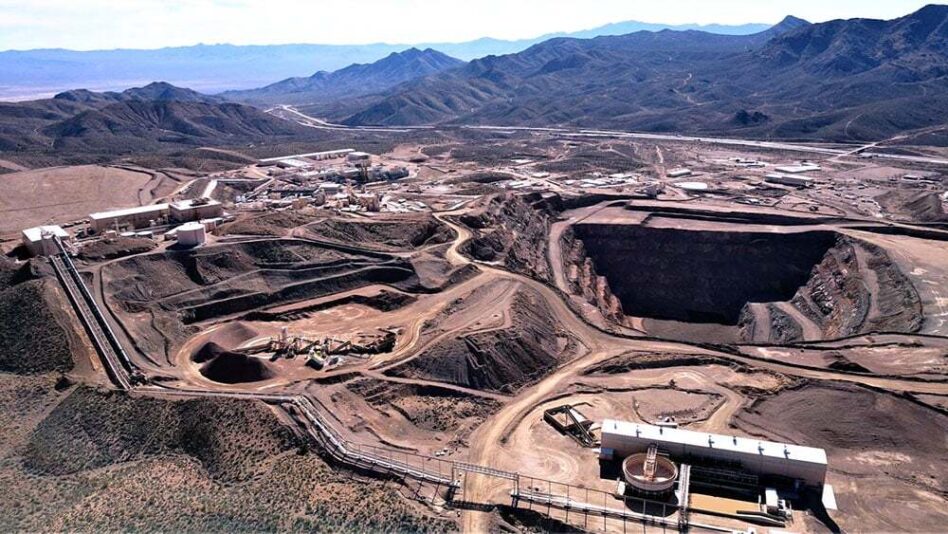

- Last July, the Pentagon shelled out $400M for a 15 percent stake in Las Vegas-based rare earths mining company MP Materials, making it the company’s largest stakeholder.

- In November, Vulcan Elements inked a $1.4B deal with the Pentagon, Commerce Department, and ReElement Technologies to scale up its rare earth magnet production facility.

- In December, Korea Zinc announced plans to build a $7.4B critical minerals refinery in Tennessee backed by US government funding.

- Last month, Trump signed an executive order directing trade officials to negotiate agreements with partners to “address the threatened impairment of national security with respect to imports of processed critical minerals and their derivative products.”

Stocking up: While the US already maintains a critical mineral stockpile for the defense-industrial base, this new $12B project would take it a step further by creating a critical mineral equivalent to the Strategic Petroleum Reserve that includes the private sector.

Details are sparse (including who’s putting up the $1.7B in private sector funding), but, according to Bloomberg, more than a dozen companies have signed onto the initiative, including General Motors, Stellantis, Boeing, and Google.

- Under Project Vault, the stockpile will help manufacturers insulate themselves from volatility in critical mineral prices without needing to build up their own reserves.

- In turn, the US government will procure and store the critical minerals and charge participating manufacturers for storage and interest on the loan.

This sounds like a pretty good deal for manufacturers, but it also looks like the White House may be moving away from parts of their earlier deals with domestic critical mineral companies.

Last week, Reuters reported that officials are considering scaling back plans to guarantee a floor price for critical minerals projects (introduced last summer under a $400M investment in MP Materials) due to funding challenges and the complexity of overseeing market pricing.

But for our critical mineral friends out there, worry not: Congress could save the day. Last month, a bipartisan team of lawmakers proposed creating a $2.5B agency dedicated to supporting the production and processing of rare earths and other critical minerals.